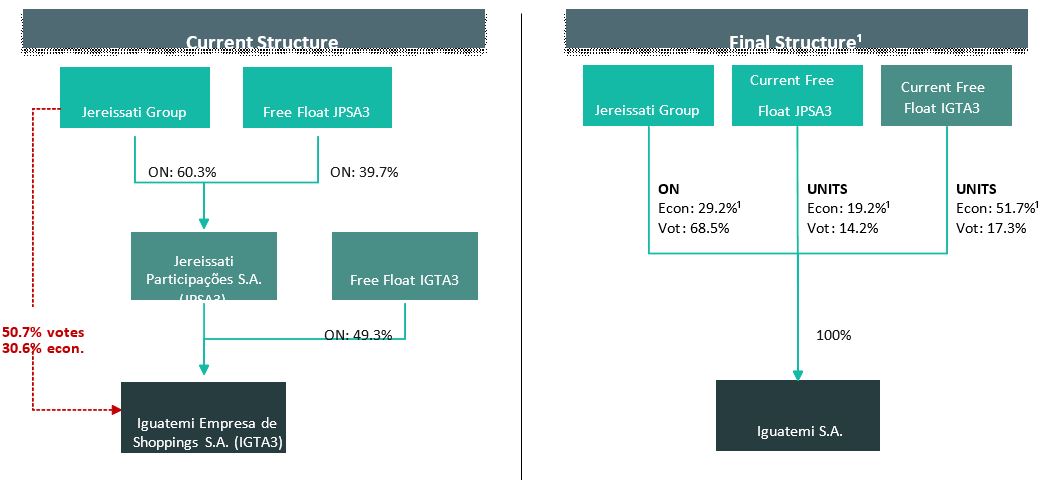

| São Paulo, June 7, 2021 - Iguatemi Empresa de Shopping Centers S.A. (“Iguatemi” or “Company”) [B3: IGTA3] hereby informs its shareholders and the market in general that, on this date, their Board of Directors decided to initiate a process aiming at a corporate reorganization of the Companies, to be submitted for approval by their shareholders at their respective General Meetings in due course. The corporate reorganization aims to simplify the corporate structure of the Companies, consolidating their shareholding bases in a single company, without changing their control structure, thus providing an increase in the liquidity of their shares and a greater capacity for capitalization and investment. The corporate reorganization will consist on the merger of IESC’s shares by Jereissati pursuant to Article 252 of Law No. 6,404/76, by which all shares issued by IESC that are not currently held by Jereissati will be merged into Jereissati, thereby making IESC a wholly-owned subsidiary of Jereissati ("Transaction"). Upon completion of the Transaction, all shares issued by IESC will become of Jereissati’s property. IESC’s shareholders who had their shares merged into Jereissati will receive in exchange new shares issued by Jereissati, in the form of securities deposit receipts (units). Once completed, the Transaction will allow the creation of Iguatemi S.A., a new name to be adopted by Jereissati, which will bring together the whole shareholding bases of IESC and Jereissati in a single publicly-held company, and will have its shares traded, in the form of Units, in the Level 1 listing segment of B3 S.A. – Brasil, Bolsa e Balcão ("B3"), but with shareholder rights and governance practices substantially similar to those required by the B3 Novo Mercado Regulation, with a free float estimated to be 45% higher than the current free float of IESC and additional capacity for new investments and acquisitions ("Iguatemi S.A."). 1. Main Benefits of the Transaction The unification of the Companies' shareholding bases will allow the increase of their investment capacity and growth, without increasing indebtedness, placing the Companies in a more favorable position to participate in future consolidation opportunities, business combinations and acquisition of strategic assets, increasing their relevance in the Brazilian real estate market. The Companies' management trust that all these advantages and benefits will be reverted in favor of all their shareholders, who, if the Transaction is implemented, will become shareholders of Iguatemi S.A., which will directly and indirectly own all of IESC's real estate and operating assets. In addition, the Companies' management believes that this new structure concentrated in Iguatemi S.A. will result in a significant reduction in current general and administrative expenses, due to the decrease of the duplicity of deliberative bodies, as well as providing the realization of credits and other tax benefits. 2. Description of the Transaction As a condition for the implementation of the Transaction, the Companies' mangement will submit to their shareholders, at the respective General Meetings, the matters described below. Jereissati's management will submit to its shareholders, in addition to the proposal of the merger of IESC’s shares, proposals of (a) amendments to the Bylaws to create preferred shares, with the right to vote on certain matters, to be elaborated in Jereissati's Bylaws and the right to dividends or other proceeds distributed in amounts equivalent to 3 (three) times those to which the common shares will be entitled; (b) voluntary conversion of the common shares, issued by Jereissati, into preferred shares will have to follow the proportion of 3 (three) common shares for each preferred share; (c) Jereissati's adhesion to the special listing segment of Level 1 of B3; (d) the creation of a unit program, each Unit will be underlain by 1 (one) common share and 2 (two) preferred shares issued by Jereissati; (e) amendments to the Bylaws to grant advantages and rights to preferred and common shares, pursuant to item 6 below; and (f) extensive reform to the Bylaws for the adherence of practices established in the Novo Mercado Regulation, amendments in the general structure of management and other mechanisms, which strengthen the commitment with corporate governance. IESC's management will submit to its shareholders, in addition to the propososal of merger of its shares into Jereissati, proposals to (a) waive Jereissati's entry into the special segment of the Novo Mercado listing; and (b) exempt the realization of a tender offer to acquire shares to delist from the Novo Mercado segment of B3. With the implementation of the Transaction, Iguatemi S.A. will be promoted to the Level 1 listing segment of B3, being certain, however, that the Bylaws of Iguatemi S.A. will guarantee its shareholders rights substantially similar to those guaranteed by the B3 Novo Mercado Regulation, except for the possibility of issuing preferred shares. The Companies' management trust that the implementation of governance and control mechanisms will strengthen the management as well as control the administrative bodies and the full alignment of interests among all the shareholders of Iguatemi S.A., pursuant to item 6 below. The Transaction’s steps contemplated above are inseparable, interdependent and linked to each other, being part of a single legal business, the completion of which will be subject to the applicable corporate approvals, having as an underlying condition that each of the steps will not be effective individually, but only with the approval of the other steps. The Transaction’s approval will not affect Jereissati's registration as a publicly-held company and its issued Units will be traded at Level 1 of B3's governance. Considering that, as a result of the Transaction, IESC will become a wholly-owned subsidiary of Jereissati and will keep its issued and outstanding debentures and certificates of real estate receivables, IESC will have its register as a publicly-held company converted from category "A" to category "B". The Companies inform that the Transaction’s approval will be subjected to a favorable vote of the majority of minority shareholders voting at the Companies’ General Meetings, so that the vote of their respective controlling shareholders will not be decisive in the approval of the Transaction and will only be delivered to meet the minimum quorum required by law to approve it, in accordance to the decision of the majority of the outstanding shares’ holders, as necessary for the implementation of the Transaction. 3. Independent Committee, Exchange Ratio of the shares and its criteria. Despite the fact that the management of the Companies have voluntarily resolved to submit the approval of the Transaction to the majority of the non-controlling shareholders voting at the Companies' General Meetings, IESC's Board of Directors, additionaly, pursuant to CVM Guidance Opinion No. 35 of September 1, 2008 ("CVM Opinion 35"), approved the formation, under temporary conditions, of a statutory independent special committee with the specific task to negotiate the applicable exchange ratio regarding the unification of the Companies' shareholding bases, and submit its recommendations to IESC’s Board of Directors ("IESC’s Independent Committee"). IESC’s management clarifies that IESC’s Independent Committee will be composed of three non-officer members, all independants, who must necessarily have recognized technical capacity and who will be chosen and disclosed in due course. As recommended by the CVM Opinion 35, IESC's Board of Directors also approved, on this date, the convening of a General Meeting to decide on the amendment of a temporary provision to the Bylaws to regulate the operating terms and conditions of IESC’s Independent Committee, as well as the appointment of its members. Regardless of the discussions of IESC's Independent Committee and of the Board of Directors of Jereissati, the controlling shareholders of the Companies informed their respective Boards of Directors that, in their view, the exchange ratio should take into account an evaluation of Jereissati based on the value of its interest in IESC (based on the weighted average market value of IESC shares in the thirty (30) trading sessions prior to the date hereof), net of all other assets and liabilities of Jereissati on the valuation date, thereby assuring to the non-controlling shareholders of IESC a 10% premium over the weighted average market value of its shares in the thirty (30) trading sessions preceding the date hereof. The statement above only reflects the vision of the Companies’ controlling shareholders and simply aims to guide the analysis and negotiation of the exchange ratio by IESC's Independent Committee with Jereissati’s management, without limiting the autonomy of IESC's Independent Committee’s work and discretion in negotiating, along with recommending, its exchange ratio. The exchange ratio will be submitted to the shareholders of the Companies at the time of the General Meetings convened to decide on the Transaction.  1 Estimate considers: (i) a 10% indicative premium for IGTA3, (ii) a calculation net of assets and obligations of JP S.A., e (iii) 80% of voluntary conversion of JPSA’s float. 4. Company’s Valuations and share exchange ratio calculated in accordance with Article 264 of Law No. 6.404/76. The Companies’ management must hire a specialized company to evaluate IESC’s shares that will be merged into Jereissati’s assets for the purpose of capital increase due to the Transaction. Furthermore, in compliance with Article 264 of Law No. 6.404/76 and Article 8 of CVM Instruction No. 565/15 (“CVM Instruction 565/15”), a specialized company will be hired to prepare a valuation report on the net equity, at market value, of both Companies, at the same reference date. The Companies also inform that, in compliance with the CVM Instruction 565/15, (i) the financial statements that will serve as the basis for the Transaction will be audited by an independent auditor registered at the CVM; and (ii) pro forma financial information of the company resulting from the Transaction will be prepared based on the date of the financial statements mentioned above, as if the Transaction already existed. 5. Right to Withdraw. Should the Transaction be aproved, in accordance with Article 252 of Law No. 6.404/76, the Companies’ dissenting shareholders at the resolution will be guaranteed the right to withdraw, in reference to shares held on the date of the disclosure of this material fact and maintained by such shareholders, uninterruptly, until the approval of the Transaction. The amount to be paid as reimbursement to the dissenting shareholders of the Companies at the resolution will be disclosed in due course when the General Meetings will convene to decide on the approval of the Transaction. 6. Adherence to the practices set forth in the Novo Mercado Regulation, management’s general structure and enhancement of corporate governance mechanisms. 6.1 Adherence to the practice set forth in the Novo Mercado Regulation Iguatemi S.A.’s Bylaws and the corporate governance practices adopted will guarantee rights to its shareholders as well as provide governance mechanisms substancially similar to those required by the B3 Novo Mercado Regulation, as set forth therein, including the: - prohibition of a provision that limits the number of votes from shareholders or group of shareholders to less than 5% or prevents the exercise of an affirmative vote or imposes a burden on shareholders who voted in favor of the suppression or amendment of statutory clauses;

- maintenance of outstanding shares of at least 25% of the share capital, except in cases admitted by the Novo Mercado Regulation;

- exertion of its best efforts towards shareholding dispersion in the public offering of distribution of shares;

- unified term of 2 (two) years maximum for the Board of Directors;

- Board of Directors which must be composed of 2 (two) independent members or, rounding up, 20% of its members, whichever is greater;

- implementation of the Board of Directors’ evaluation process, advisory committees and Executive Board;

- disclosure of the administrative bodies’ compensation, per body, with the largest, the lowest and the average value of the annual compensation, fixed and variable;

- prohibition of cumulating positions as the Board of Directors’ Chairman [or Vice-Chairman] and Chief Executive Officer;

- obligation of the Board of Directors to issue its opinion in the event of a tender offer aiming at the acquisition of the company’s shares;

- creation of the audit and internal audit committees, as well as areas of compliance and internal controls;

- disclosure of periodic information, preparation of documents and policies, including the:

- compensation policy and appointment of members of the Board of Directors, its advisory committees and statutory executive board;

- risk management policy;

- related party transactions and conflict of interests situations policy, and

- disclosure and securities trading policy.

- carry out of a tender offer for the acquisition of all shares issued by the company in the event of direct or indirect disposal of the company's control, under equal conditions to those held by the controlling shareholder, being certain that each preferred share will be equivalent to 3 (three) times the amount received for each common share issued by the company in the tender offer;

- dispute resolution through arbitration before the Câmara de Arbitragem do Mercado;

- carry out of a tender offer for the exit of Level 1 of B3 in compliance with the requirements and other rules set forth in the Novo Mercado Regulation; and

- provisions on sanctions and responsabilities set forth in the Novo Mercado Regulation.

Thus, the exception, mainly, of the coexistence of common and preferred shares, the Bylaws of Iguatemi S.A. will have to reflect the requirements of the Novo Mercado Regulation. In addition, Iguatemi S.A.'s Bylaws must provide that the approval of the following matters will be subjected to the approval of the majority of the shareholders, holding preferred shares, present at the special meeting convened to decide on them: - operations offered by Management and which involve the Company’s transformation, merger or spin-off.

- approval of proposals regarding the execution of contracts between Iguatemi S.A. and related parties involving, directly or indirectly, Iguatemi S.A. and its controlling shareholder;

- valuation of assets to be provided into capital increases;

- choice of an institution or specialized company to decide the economic value of Iguatemi S.A.’s shares in the cases set forth in the Bylaws; and

- amendment or removal of statutory provisions that may alter or reduce any of the preferred shares’ rights.

6.2 General Structure of Management and Control Once the Transaction is completed, IESC will become a wholly-owned subsidiary of Iguatemi S.A. and its registration as a publicly-held company will be changed to category “B” due to the existence of other securities of its own issuance, such as debentures and certificates of real estate receivables. Iguatemi S.A. will become the main company of the group and its management bodies will concentrate the main decisions that will guide the Companies' business and management. Upon completion of the Transaction, the Board of Directors of Iguatemi S.A. will take the necessary resolutions to replace Jereissati's current executive board with the current members of IESC’s executive board, subject to the provisions in item 6.4 below in relation to the succession process of the CEO of IESC, as well as to convene the General Meeting of Iguatemi S.A. to decide on the election of the current independent members of IESC’s Board of Directors to the Board of Directors of Iguatemi S.A. The Companies' management trust that this new structure will allow a significant reduction in the current general and administrative expenses, due to the reduction of the duplicity of deliberative bodies. Finally, Iguatemi S.A. will remain counting on the control structure of the Jereissati group, which actively participates in its main strategic decisions, thus being able to benefit from the proven experience and know-how in the sector, with a positive performance and result track record, credibility and reputation in the market, which, in the Company's judgment, aligns with its interests and the interests of the set of shareholders and other stakeholders of Iguatemi S.A. 6.3 Reinforcement of the Corporate Governance In the context of the Transaction, statutory advisory committees to the Board of Directors will be established at Iguatemi S.A., in the following form: - Finance and Capital Allocation Committee: statutory committee with the participation of independent members, board members or not;

- Audit and Related Parties Committee: statutory committee, consits of only independent members, regardless of being a board member;

- People, Culture and Organization Committee: statutory committee with the participation of independent members, board members or not; and

- Risk and Compliance Committee: statutory committee with the participation of independent members, board members or not.

6.4 Beginning of the Succession Process of IESC’s CEO At a meeting held on this date, the IESC’s Board of Directors also approved the initiation of the succession process of the IESC’s CEO, with the necessary measures taken regarding the appointment of the current Financial Vice President, (CFO) Ms. Cristina Anne Betts, from January 1st, 2022, to take the position of CEO of IESC (and, if the Transaction is approved, of the future Iguatemi S.A.), succeeding the current CEO, Mr. Carlos Jereissati. Ms. Cristina Anne Betts joined IESC in April of 2008 and has ever since held the position of Financial Vice President (CFO) and is responsible for the Finance, Technology, Management and Strategic Planning affairs, as well as the operations regarding iRetail and Iguatemi 365. Prior to joining IESC, she served as an executive and member of the Board of Directors in large companies of various segments. Ms. Cristina Anne Betts holds a degree in business administration from Fundação Getúlio Vargas (FGV) with an MBA from INSEAD in France and is currently a member of the Board of Directors of B3 S.A., the finance committee at Votorantim Cimentos S.A. and the fiscal board at Rumo S.A. The succession process of the CEO of IESC, now announced, follows the guidelines already established by its Board of Directors, related to the Company's governance, seeking the values and attributes developed in its inner corporate environment, forming its operational culture, which aim to value seriousness, ethics, quality and efficiency, demmed fundamental to the growth of IESC since its foundation. From this date on, the transition of position will be conducted by Mr. Carlos Jereissati, who has held the position of CEO of IESC since 2006 and was responsible for leading the Company to a relevant growth of its Gross Leasable Area, Net Revenue and Operating and Financial Results, with the Company's achievement of important recognitions, becoming one of the forty most valuable brands in the country according to Kantar Ibope / WPP, one of the 15 best companies to work in Retail, as well as one of the best companies for women to work, both according to Great Places to Work (GPTW). Mr. Carlos Jereissati will remain in the Company's management as a member of the Board of Directors, contributing his knowledge and experience to the general orientation of businesses and to the discussion of relevant and strategic topics for the Company's continued development. 7. Other Relevant Information. The conclusion of the Transaction is conditional to (a) the result of the negotiation regarding the exchange ratio between the Independent Committee of Iguatemi and the management of Jereissati; and (b) that the exercise of the withdrawal right by the Companies’ Shareholders, at the discretion of their managements, does not harm the economic and financial stability of the Companies The necessary documents for the resolution, by the shareholders of the Companies, regarding the Transaction, including the protocol and justification, valuation reports, the pro forma balance sheet with reasonable assurance and other information required by the CVM Instruction 481/09 and CVM Instruction 565/15, will be available for consultation by shareholders at the Companies' headquarters and on the investor relations website of Jereissati (https://www.jereissati.com.br/),Iguatemi’s (https://ri.iguatemi.com.br/), through the Empresas.Net System, on the pages of the Brazilian Securities and Exchange Commission (www.cvm.gov.br) and B3 S.A. – Brasil, Bolsa, Balcão (www.b3.com.br), when the General Meetings are convened to decide on the approval of the Transaction. The Companies clarify that in the Transaction Jereissati is being advised by XP Investimentos and Iguatemi is being advised by BTG Pactual. The Companies inform that they will keep their shareholders and the market in general updated on any progress or news regarding the Transaction and the structure of management. Cristina Anne Betts

CFO and Investor Relations Director

Iguatemi Empresa de Shoppings Centers S/A |

Comentários

Postar um comentário